45l tax credit form

If youre not sure you qualify for the. Complete Edit or Print Tax Forms Instantly.

The 2 000 45l Efficiency Tax Credit What You Need To Know Attainable Home

45L Tax Credit Form - Tacoma Energy Products and Solutions New Home Construction.

. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Weve already started mailing checks. Ad State-specific Legal Forms Form Packages for Government Services.

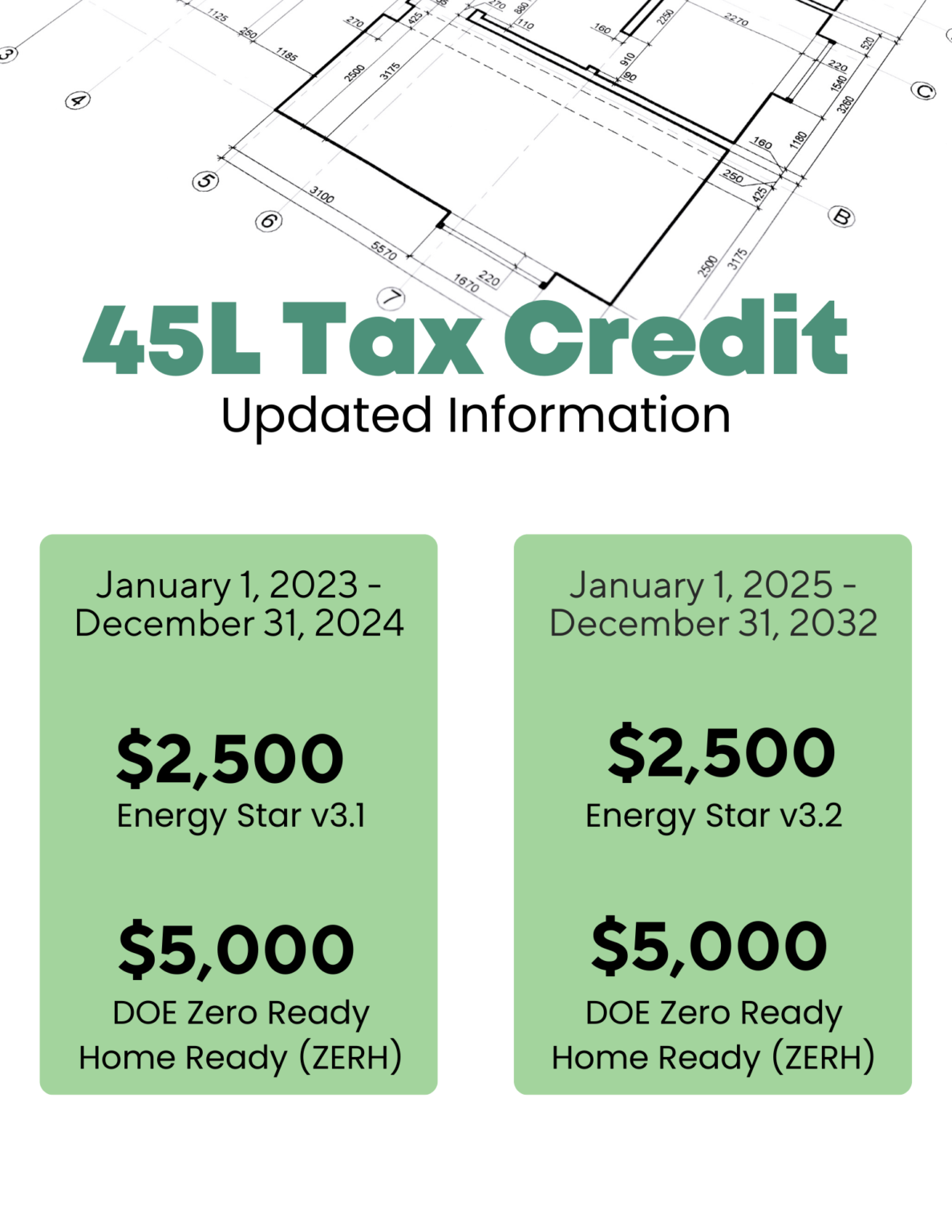

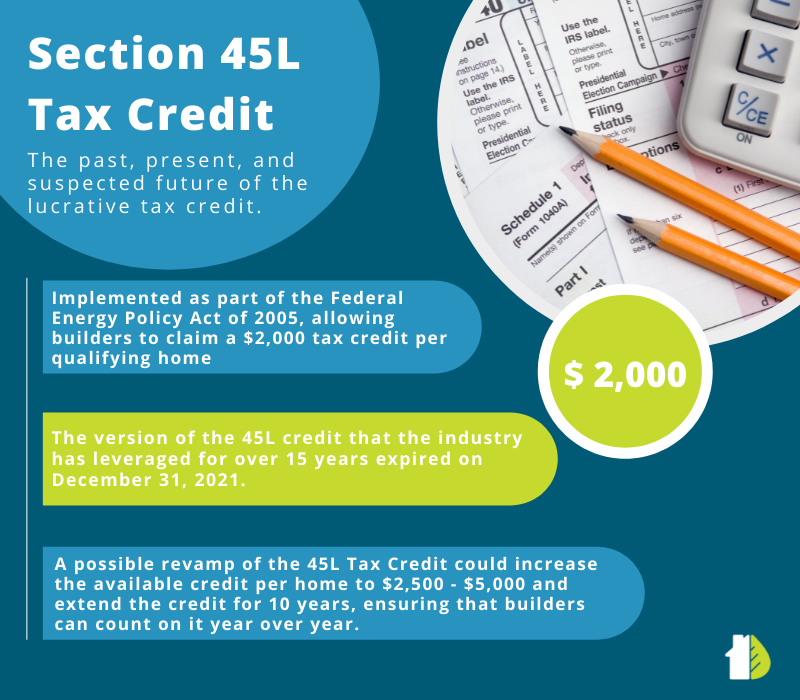

The Internal Revenue Code IRC Section 45L is a 2000 per dwelling unit 1000 for manufactured homes tax credit for each new energy-efficient home which is constructed by. To receive more information. The version of the 45L Tax Credit that our industry has leveraged for over 15 years expired on December 31 2021 meaning that there is no active 45L Tax Credit for homes built.

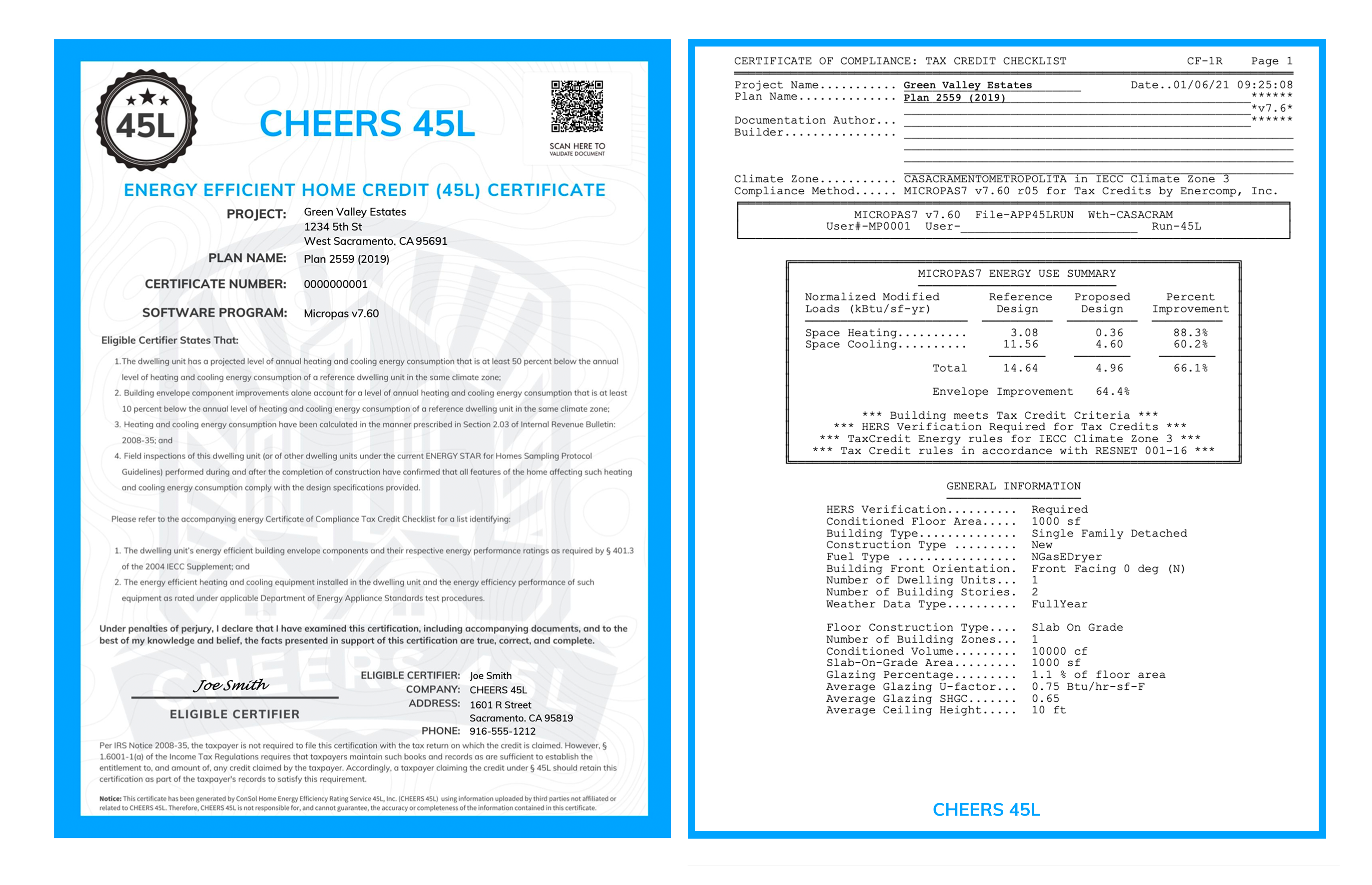

Energy credit part of the investment tax credit must not again be considered in determining the energy efficient home credit. Find out if you have qualified for this. Once the certifier has provided you with all the certifications you need you will have to use IRS Form 8908 Energy Efficient Home Credit to file for the 45L tax credit.

Find Forms for Your Industry in Minutes. Use this lookup to determine the amount youll receive for the homeowner tax rebate credit HTRC. A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is claimed.

Good morning Its Monday August 22 2022. Access IRS Tax Forms. The Recovery Friendly Workplace Tax Credit Is Designed To Reward Eligible Employers.

45L Tax Credit 45L is for residential and multi-family properties. The 45L Tax Credit originally made effective on 112006. Forms - Island Federal Credit Union Hauppauge NY Open an Account.

Credit evaluation is completed after admission and prior to registration. We model every new home in the most cost effective energy efficient way. Streamlined Document Workflows for Any Industry.

Recent tax legislation extended the Energy Efficient Home Credit to developers of energy-efficient homes and apartment buildings. Eligible contractors use Form 8908 to claim a credit for each qualified energy efficient home sold or leased to another person during the tax year for use as a residence. Hofstra offers comprehensive academic advisement prior to class registration.

The Recovery Friendly Workplace Tax Credit Is Designed To Reward Eligible Employers. Enter total energy efficient home. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

You must pay the Real Property Transfer Tax RPTT on sales grants assignments transfers or surrenders of real. The 45L Tax Credit is available for Builders who have financed the construction of energy efficient homes and then leased or sold them. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

The 45L tax credit for energy-efficient homes provides 2000 per unit for owner-occupied or rental dwelling buildings that meet certain qualifications. Real Property Transfer Tax Filing Extensions and the COVID-19 Outbreak. The 2000 tax credit per building unit is available to developers and builders of properties that are more energy-efficient than a.

The 45L Energy Efficient Home Credit offers builders developers a 2000 federal tax credit per energy efficient home 2000 per qualified home Single family and m ulti-family projects up to.

California Energy Commission 2013 Building Energy Efficiency Standards Minimum Water Heater Energy How To Memorize Things Energy Consulting Worksheet Template

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

45l Tax Credit Services Using Doe Approved Software

The Home Builders Energy Efficient Tax Credit An Faq

Taxes Paparazzi Business This Post Is Intended To Help You Be Organized This Year And Help Paparazzi Fashion Paparazzi Jewelry Displays Paparazzi Consultant

Collect 2 000 Tax Credit For Each New Home Or Dwelling Unit Built Tax Credits The Unit Energy

Germany Visa From Pakistan Visa Requirements Process Documents Germany Germany Tourist Travel Insurance Policy

The Home Builders Energy Efficient Tax Credit An Faq

Taxes Paparazzi Business This Post Is Intended To Help You Be Organized This Year And H Paparazzi Jewelry Images Paparazzi Jewelry Paparazzi Jewelry Displays

Section 45l Energy Tax Credit Past Present And Future Ekotrope

Grow Your Tax Practice By Understanding Energy Tax Credits Corvee

Countdown To 2020 On October 25 2019 From 7 30am To 11am Join Us In Sacramento With The Building Industry As Energy Consulting Coding Software Improve Energy

This Represents Sporadic Because The Chart Numbers Are Going Up And Down Like Crazy Vocab Vocabulary Facetime