estate tax exemption 2022 inflation adjustment

The alternative minimum tax exemption for estates and trusts will be 26500 was 25700 and the phaseout of the exemption will start at 88300 was 85650. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000.

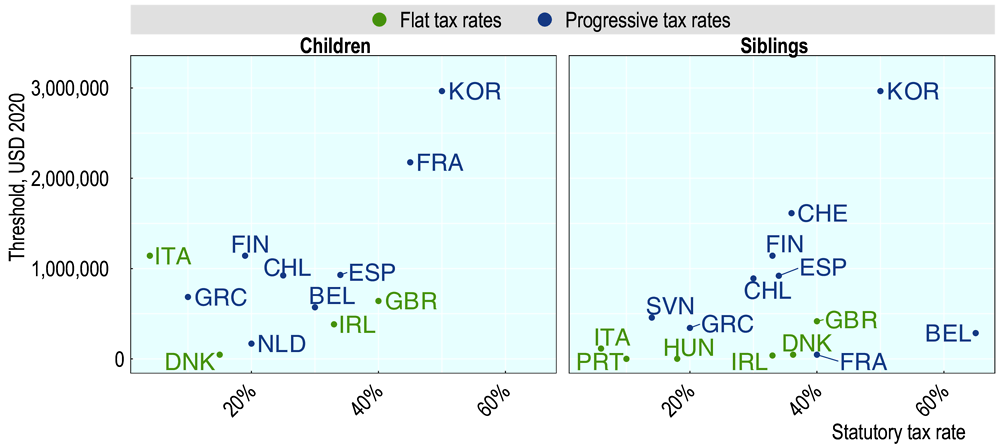

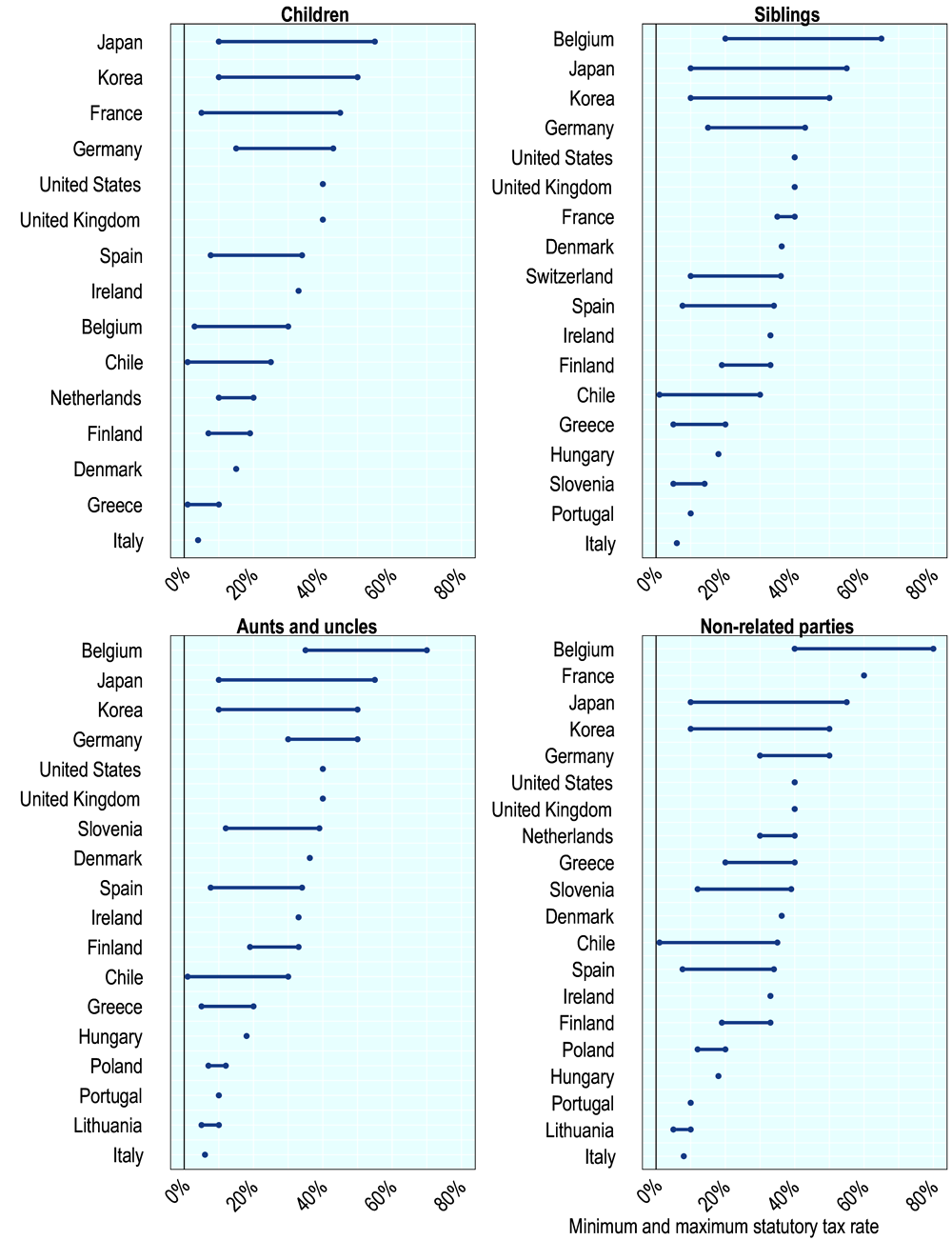

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

On November 10 2021 the IRS released tax inflation adjustments for 2022.

. NYS estate tax exemption is tied to the pre-TCJA federal BEA and is 5930000 in 2021 NYS has not yet released inflation adjustments for 2022. With the inflation adjustment Rev. For single taxpayers and married individuals.

The IRS issued Rev. The amount is adjusted each year for inflation so thats not a surprise. For people who pass away in 2022 the.

This is the amount that each person can give to another person without using. Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount. The estate tax exemption is adjusted for inflation every year.

The amount increased from 15000 in 2021. The federal estate tax exemption for 2022 is 1206 million. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation.

Alternative Minimum Tax Exemption for Single Filers The. These changes may impact you if. Increase in Connecticut Estate and.

The IRS recently issued the 2022 inflation adjustments for various tax provisions including increased exemption amounts for the estate gift and generation skipping transfer taxes and. The tax year 2022 adjustments described below generally apply to tax returns filed in 2023. The Washington estate tax is not portable for married couples.

Due to an adjustment for inflation annual tax-free gifts by an individual in 2022 increase to 16000 per gift recipient and 32000 by a married couple. 2021-45 Wednesday adjusting for inflation a wide array of amounts applicable to the 2022 tax year for use with individual business and estate and trust. The annual inflation adjustment for federal gift estate and generation-skipping tax exemption increased from 117 million in 2021 to 12060000 million in 2022.

Notably the federal estate and gift tax exemption amount will increase from 117 million to 1206. The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022. The top income tax rate will be 37 for individual single taxpayers with incomes greater than.

The gift tax annual exclusion amount increased to 16000 for 2022. The annual inflation adjustment for federal gift estate and generation-skipping tax. 2021-45 provides that for tax year 2022.

The new federal estate and gift tax exemption beginning for 2022 increases to 12060000 per person due to the inflation adjustment. Due to an adjustment for inflation annual tax-free gifts by an individual in 2022 increase to 16000 per gift recipient and 32000 by a married couple. Transfer tax exemption for lifetime gifts death transfers and generation-skipping transfers.

Increase in the Federal Estate and. Increase in the Federal. The tax items for tax year 2022 of greatest interest to most taxpayers include the following dollar amounts.

Increase in Connecticut Estate and. The foreign earned income exclusion for tax year 2022 increased to 112000 up from 108700 for tax year 2021. The new federal estate and gift tax exemption beginning for 2022 increases to 12060000 per person due to the inflation adjustment.

1 The size of the estate tax exemption meant. On the federal level the estate tax exemption is portable between spouses. But its still a big deal when the new exemption is announced each year because theres a lot at stake for.

The IRS also announced the annual inflation adjustment for the federal gift estate and generation-skipping transfer GST tax exemption which increases the amount sheltered. NYS does not impose an. The standard deduction for married couples filing jointly for tax year 2022 rises to 25900 up 800 from the prior year.

How Could We Reform The Estate Tax Tax Policy Center

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Estate Tax Examples Of Estate Tax Estate Tax Rate

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

Biden Greenbook Estate Tax Proposals Should You Care

How Could We Reform The Estate Tax Tax Policy Center

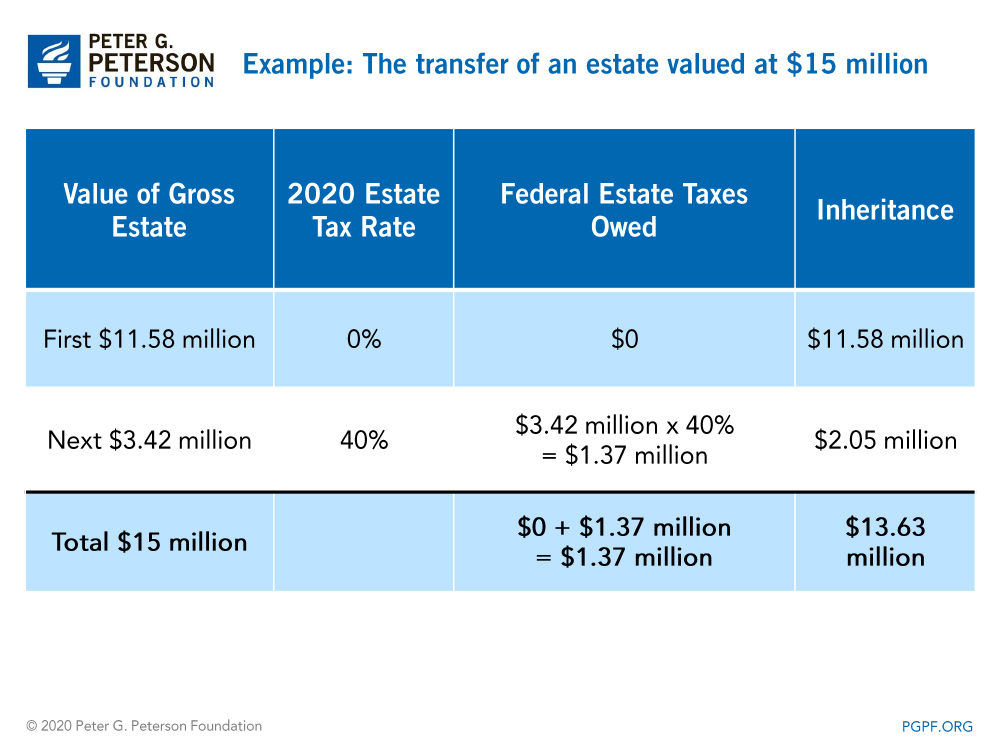

What Are Estate And Gift Taxes And How Do They Work

What Are Estate And Gift Taxes And How Do They Work

Inheritance Tax Definition Taxedu Glossary Terms

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Eight Things You Need To Know About The Death Tax Before You Die

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Estate Tax Definition Federal Estate Tax Taxedu

The Estate Tax On Stocks And Dividends Intelligent Income By Simply Safe Dividends

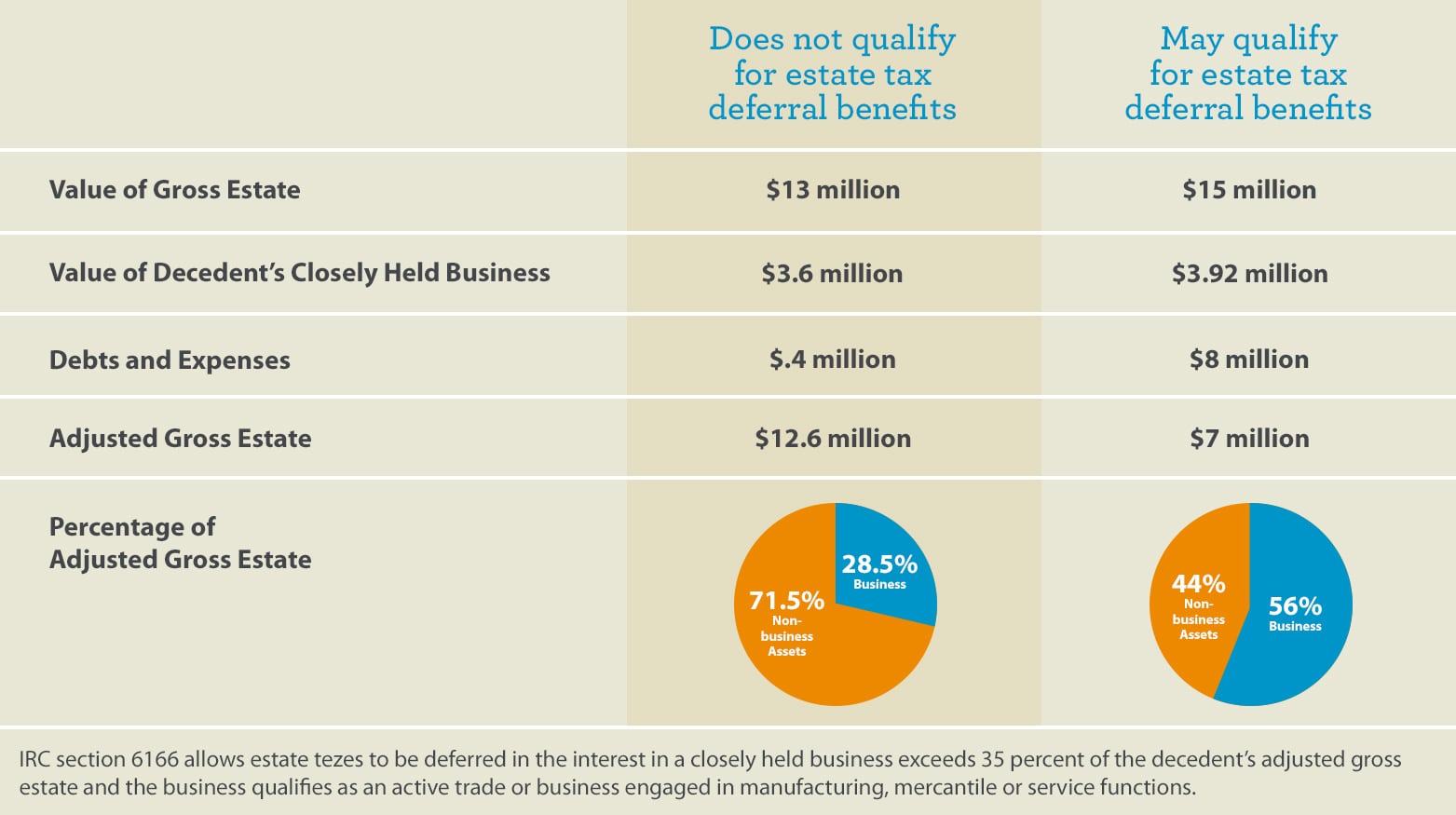

Estate Taxes On A Closely Held Business Under Irc 6166 Wells Fargo Conversations